Running a small business today often feels like waging a war on multiple fronts. Sales data in one app, leads buried in another, reviews to respond to on three different platforms, and finances scattered across spreadsheets – it’s a daily battle just to stay organized. Juggling so many disconnected tools doesn’t just waste time; it makes it nearly impossible to see the bigger picture of how your business is really performing.

That’s where the idea of a “war room” comes in, but not in the old sense of maps and pins on a wall. In today’s digital landscape, a business war room is your data dashboard: a single, unified hub where sales, leads, reviews, finances, and tasks all come together in real time. With the right dashboard in place, small businesses can shift from fighting fires to making proactive, confident decisions that drive growth.

Streamlined Business Operations

A unified data dashboard will reduce clutter and focus on the numbers and activities that move your business forward. By consolidating your operations into a single view, you gain the clarity to act quickly and strategically. The most effective dashboards bring together five key elements every small business should track:

- Sales: Monitor revenue, pipeline stages, and close rates to see whether your growth strategy is on track.

- Leads: Track new inquiries, conversion rates, and follow-ups so no opportunity slips through the cracks.

- Reviews: Stay on top of customer sentiment by responding to feedback in real time and spotting trends that affect your reputation.

- Finances: Keep cash flow, expenses, and outstanding invoices visible to maintain financial health and make smart investment decisions.

- Tasks: Align your team by assigning, tracking, and completing daily responsibilities without relying on scattered notes or endless email chains.

Together, these elements give you a complete picture of your business health, allowing you to spot gaps, double down on what’s working, and keep your entire operation running smoothly from one central hub.

Build Stronger Relationships With Your Customers Using Our Mobile CRM Software for Small Businesses

Our robust CRM software helps you build better relationships with your existing customers and nurture new leads. You can also view and manage all your communications and interactions from anywhere, including on your mobile device or desktop computer.

How to Build a Data Dashboard

1. Set the mission and KPIs.

2. Inventory your systems.

3. Connect your data sources.

4. Standardize fields and naming.

5. Build your layout.

6. Set targets and track trends.

7. Add filters and drill-downs.

8. Automate the follow-through.

9. Establish check-ins.

10. Adjust as needed.

1. Set the mission and KPIs.

To begin, decide what the dashboard must answer at a glance (e.g., “Are we on pace for monthly revenue?” “Where are the leads stalling?”). Then, pick 5-8 KPIs max. These could be:

- Sales: revenue, win rate, average deal size

- Leads: new leads by source, first-response time

- Reviews: average rating, new reviews per week, response time

- Finances: cash-on-hand/cash flow, paid vs. overdue invoices

- Tasks: open vs. completed, on-time completion rate, overdue percentage

2. Audit your systems.

Before you can bring everything together in a data dashboard, you need to know where your data lives today. Most small businesses don’t realize how many platforms they’re juggling until they write them all down. This step involves creating a clear map: identifying what information is stored in each tool and who on your team is responsible for it.

Here’s how to think about it:

- Leads

- Where the data lives: CRM or contact manager, email inboxes, web forms, phone logs, live chat tools, or even sticky notes if things aren’t centralized yet.

- Who owns it: Typically, your sales rep, front desk, or whoever is responsible for following up with new inquiries.

- Sales

- Where the data lives: Sales pipeline tool, quoting software, invoicing system, or spreadsheets.

- Who owns it: Your sales manager, account executive, or, in a small team, often the business owner.

- Reviews

- Where the data lives: Google Business Profile, Facebook, Yelp, and industry-specific directories.

- Who owns it: The marketing lead, customer service rep, or anyone responsible for monitoring customer satisfaction and reputation.

- Finances

- Where the data lives: Accounting software, payment processors, invoices in your CRM, or bank statements.

- Who owns it: Accountant, bookkeeper, or the owner if finances are still handled in-house.

- Tasks and Operations

- Where the data lives: To-do lists, project management apps, appointment schedulers, or sticky notes on a monitor.

- Who owns it: Team leads, operations managers, or whoever is responsible for keeping day-to-day work on track.

By documenting these systems and owners, you’ll see exactly where the silos are. It also helps you make informed decisions about what to integrate first, as not knowing where your data begins prevents you from unifying it into a single, clean dashboard.

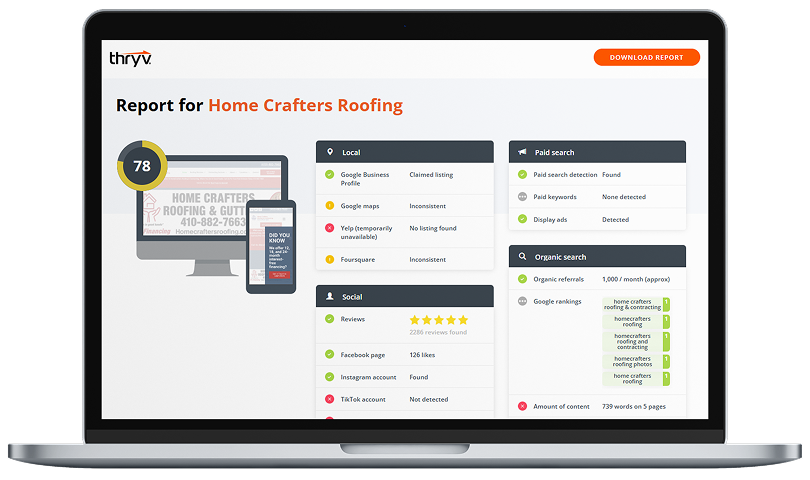

If you’re using Thryv: Business Center Pro (CRM/tasks/appointments), Marketing Center Pro (campaigns & sources), Listings/Reviews (reputation), ThryvPay (payments), and Reporting Center (dashboards).

3. Connect your data sources.

Once you know where all your information lives, the next step is to bring it together in one place. Most modern tools (including Thryv) offer native integrations or simple connectors that make this process painless, so you don’t need to be a tech expert.

- Customer info and leads: Start by linking your CRM or contact manager, along with any web forms, call tracking tools, or campaign links (like UTM codes) that feed new inquiries into your system.

- Reviews: Connect platforms such as Google Business Profile, Facebook, or Yelp so every customer review and rating shows up on your dashboard in real time.

- Payments and invoicing: If you’re using ThryvPay, QuickBooks, or Xero, integrate them so you can see invoices, payments received, and outstanding balances without hopping between apps.

- Tasks and scheduling: Utilize your calendar, appointment scheduler, or task manager to view operational to-dos alongside sales, reviews, and finances.

When everything syncs into your data dashboard, you’re no longer wasting time logging into five different platforms. Instead, you get a single, accurate picture of how your business is performing at any moment.

Thryv path: Connect Listings/Reviews accounts > Link ThryvPay > Turn on Marketing source tracking > Ensure contact/lead capture forms map to your CRM fields.

We’re sharing our expert tips to help you boost productivity, eliminate time-wasting tasks, and more in this free guide.

Download Now

4. Standardize fields and naming.

Remember: clean data = clean insight. If the information feeding your dashboard is messy or inconsistent, the reports will be too. To avoid confusion, take time to set some ground rules:

- Normalize your lead sources. Instead of having one system call it “Google Ads,” another “Paid Search,” and a third “PPC,” pick a single list of options – like Google Ads, SEO, Referral, Social – and stick with it everywhere.

- Standardize your pipeline stages. Clearly define what counts as a “New Lead,” “Qualified,” or “Won.” That way, every deal is measured against the same benchmarks.

- Align your tags. Whether you’re tagging by service, location, or team member, use a consistent format so you can actually filter and compare results.

- Check formats. Make sure your dates, times, and currency are all aligned across tools (e.g., MM/DD/YYYY vs. DD/MM/YYYY). A simple mismatch can throw off reporting.

By cleaning up these details before you build your dashboard, you’ll prevent headaches later and ensure your insights are reliable.

5. Build your layout.

When designing your dashboard, don’t organize it by the tools you use; organize it by the decisions you need to make quickly. The goal is to see the big picture at a glance, with the ability to drill down if needed. Think of your dashboard like layers, starting with the most critical insights at the top and working down into details:

- Top row: Executive KPIs. Keep the essentials front and center: month-to-date revenue vs. target, your average review rating, number of new leads, current cash flow, and whether tasks are being completed on time.

- Row 2: Sales & Leads. Track the health of your pipeline: where leads are coming from, how quickly they’re being contacted, and whether your win rate is trending up or down.

- Row 3: Reputation. Monitor customer sentiment: average rating across 30/60/90 days, review volume, response times, and recurring keywords or themes in feedback.

- Row 4: Finances. Keep cash flow top of mind: invoices due this week, overdue payments, and payouts or payments received today and month-to-date.

- Row 5: Operations & Tasks. Stay on top of execution: open vs. completed tasks, service-level agreement (SLA) breaches, and upcoming appointments so nothing slips through the cracks.

By arranging your dashboard in this way, you move from high-level strategy at the top to day-to-day execution at the bottom, helping you prioritize and act without getting lost in the noise.

Thryv widgets to consider: Pipeline overview, leads by source, review summary and response queue, invoice status, ThryvPay payouts, task burn-down, and appointment utilization.

6. Set targets and track trends.

Numbers on a screen don’t mean much unless they tell you where to go next. To make your dashboard actionable, you need to set clear targets and use visual cues that highlight progress, or lack of it, at a glance.

- Set targets for each KPI. Decide what “success” looks like for every metric, whether it’s monthly revenue, lead response time, or average review rating. Without a target, you can’t measure performance.

- Use the traffic light system. Colors like red, yellow, and green instantly show how you’re doing against your goals:

- Green: You’re on track, typically 80% or more of your target.

- Yellow: You’re in caution territory, around 50–79% of the target. Pay attention and take corrective action.

- Red: You’re off track, less than 50% of target. This requires immediate attention and a plan to get back on pace.

- Track trends, not just snapshots. Add line charts or 30/60/90-day trend views to see whether you’re moving in the right direction over time. A number that looks “green” today could be trending down. Your dashboard should make that visible.

By combining targets with the traffic light system thresholds and trend lines, your dashboard becomes more than a scoreboard. It becomes a decision-making tool that tells you what’s working, what needs attention, and where to act now.

7. Add filters and drill-downs.

A great dashboard isn’t one-size-fits-all. It should be flexible enough to serve everyone on your team. The trick is to design it so each person can drill into the details that matter most to their role.

- Use filters. Allow users to slice data by date range, location, service, sales representative, or campaign. For example, an owner might want to see performance across all locations, whereas a branch manager is only concerned with their own.

- Enable click-throughs. Don’t stop at the top-level metric. Make sure each KPI links to the underlying details. For instance, clicking on “overdue invoices” should bring up the actual list of unpaid bills so someone can take action immediately.

- Save role-based views. Create tailored versions of the dashboard for different roles:

- Owner: big-picture KPIs like revenue, cash flow, and reviews.

- Operations manager: task completion, SLAs, and appointment schedules.

- Sales lead: pipeline, new leads, and win rates.

- Front desk/customer service: daily tasks, reviews to respond to, and upcoming appointments.

This way, everyone sees what’s relevant without being overwhelmed, and the whole team can work from the same source of truth.

8. Automate the follow-through.

A dashboard shouldn’t just show you what’s happening; it should help you act on it. By connecting automation to your insights, you turn data into processes that save time and ensure nothing slips through the cracks.

- Leads: If a new inquiry hasn’t been contacted within a set timeframe, your system can automatically create a follow-up task or send a reminder text/email so no lead goes cold.

- Reviews: Route low-star reviews (1–3 stars) to a same-day follow-up task so issues are handled quickly. With tools like ThryvAI Review Response, you can even generate a thoughtful draft reply instantly.

- Finances: Automate invoice reminders to nudge customers about overdue payments. You can also schedule payout summaries to make cash flow visible without manual check-ins.

- Tasks and operations: Set up recurring checklists for routine work and tie them to service-level agreements (SLAs), ensuring accountability and consistency across your team.

With these automations in place, your data dashboard becomes more than a reporting tool. It becomes the engine that drives timely action, better customer experiences, and a smoother business operation.

Thryv tip: Use Automations to create tasks from form submissions, missed calls, or low-rating reviews. Turn on invoice reminders and appointment reminders by default.

9. Establish check-ins.

A dashboard only creates value if you use it consistently. Think of it as a ritual that keeps your team aligned and accountable. Build these checkpoints into your calendar:

- Weekly (20–30 minutes): Run a quick KPI check-in. Call out each metric as red, yellow, or green, then log the cause, next action, responsible owner, and due date.

- Bi-weekly: Hold a meeting to address action items, ensuring sales, operations, and marketing aren’t working in silos.

- Monthly/Quarterly: Step back to review bigger-picture targets and remove any dashboard widgets that no longer serve a purpose.

Just as important as the cadence is ownership. Assign clear owners for each section. If a metric turns red, that owner is responsible for creating and executing the fix. This builds accountability into the process and ensures your dashboard is a management tool.

10. Adjust as needed.

Dashboards aren’t “set it and forget it.” To keep them accurate and useful, you need to treat them like a living system that evolves with your business.

- Validate your numbers. Regularly spot-check each widget against its source system (CRM, payment processor, review site) to make sure the data matches. If your dashboard isn’t trustworthy, your team won’t rely on it.

- Declutter and refresh. Remove unused widgets and commit to adding new, valuable insights. This keeps your dashboard lean and relevant.

- Create a metric dictionary. Document what each KPI means and how it’s calculated directly on the dashboard. That way, there’s no confusion about whether “leads” means raw inquiries, qualified leads, or something else.

By validating, pruning, and documenting regularly, your data dashboard stays clean, reliable, and actionable, helping your team make better decisions over time.

One Dashboard, Total Control

In the end, a unified data dashboard isn’t just about convenience; it’s about control. For small businesses, having all your sales, leads, reviews, finances, and tasks in one place is the ultimate advantage. It means fewer missed opportunities, less time wasted switching between platforms, and faster, smarter decisions that keep you ahead of the curve.

With Thryv, you don’t need to cobble together a patchwork of tools. Instead, you gain a single, real-time dashboard that consolidates the metrics that matter most. The result? A clearer view of your business, more confident decision-making, and the ability to run your company like a true SMB war room. Because when you can see everything in one place, you don’t just react to what’s happening, you take total control of where your business is headed.

CRM Cleanup Guide

Get your CRM data in tip-top shape — and keep it that way!